How Financial Security Shaped Civic Engagement in 2024 December 11, 2024

Diving Deeper into the Economic Roots of Disparities in Political Participation

Interested in receiving insights like this in your inbox? Sign up for our latest data and insights here.

By: Lily Stockbridge and Grayson Wormser

In a previous research study conducted with our colleagues at Urban Institute, we uncovered a strong correlation between financial security and civic engagement, highlighting significant gaps in participation among financially insecure individuals.

Ahead of the 2024 presidential election, that research laid the groundwork for examining how greater financial security often translates into increased political influence. This article dives into the post-election perceptions of financially insecure Americans in an attempt to better understand the root causes of these disparities.

FINANCIALLY INSECURE AMERICANS FEEL THEIR VOTE HAD LESS IMPACT

Civic engagement relies on a perception that we have agency, and that our actions will lend to positive change. To examine feelings of agency over time, we’ve been following the extent to which Americans feel as if their vote matters.

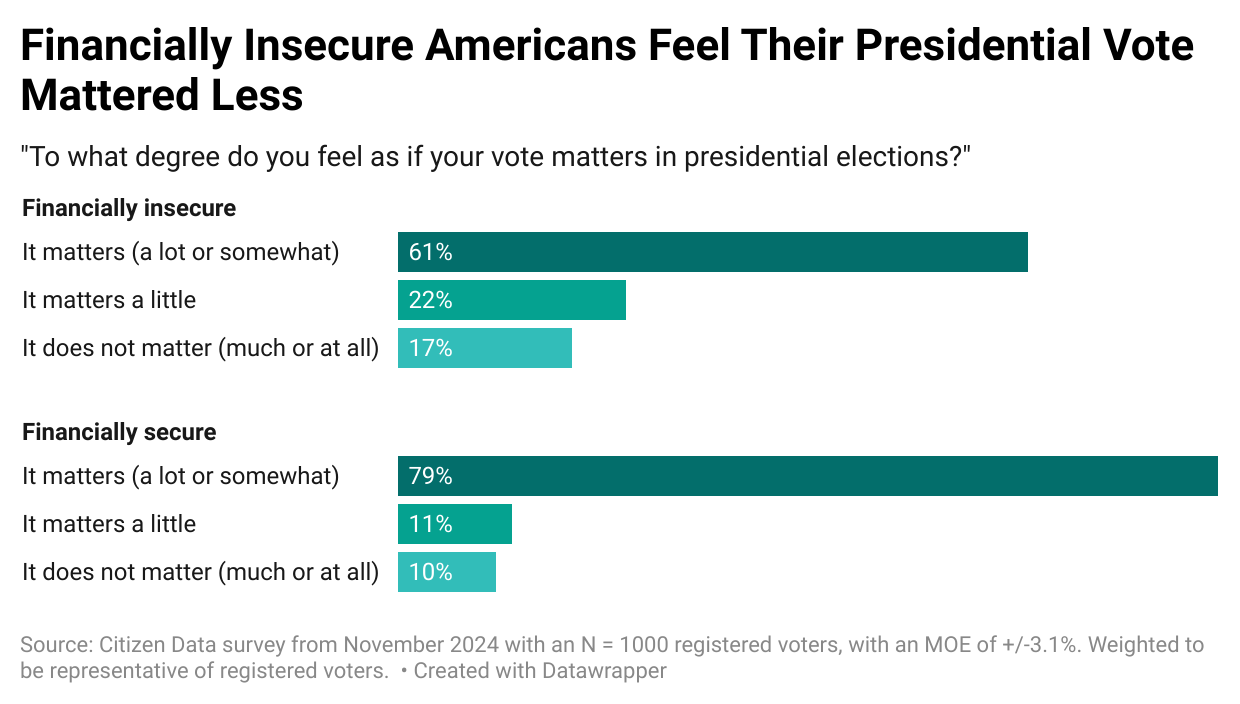

Throughout 2024, financially insecure Americans repeatedly felt that their votes mattered less, compared to financially stable voters. In October 2024, less than two-thirds (63%) of financially insecure respondents felt as if their vote for president mattered, compared to eight out of ten (83%) of financially secure respondents. Post-election, as seen below this perception declined even further among financially insecure Americans to 61%, 18 percentage points lower than financially secure voters.

At the state level, financially insecure Americans believed their vote mattered even less than at the national level, decreasing from 70% in October to 58% in November after the election. This indicates that local and state elections may seem less relevant to the immediate needs of economically vulnerable populations, with these elections often perceived as less impactful. This highlights an opportunity to better align state-level outcomes with the priorities of voters.

FINANCIALLY INSECURE AMERICANS FEEL LESS OPTIMISTIC ABOUT THE FUTURE, BUT THAT COULD BE CHANGING

Hope for a better future is another critical component and driver of civic engagement. Yet, for financially insecure Americans, this is a barrier. In fact, financially secure Americans are more than twice as likely to feel optimistic about the future of democracy (54%) than financially insecure Americans (23%).

Following the election, optimism among financially insecure individuals surged significantly, rising to 46%, suggesting a potential turning point. This seemingly paradoxical finding, where optimism about the future increases despite lingering doubts about the impact of one’s vote, could reflect relief that the election process was conducted smoothly, without violence or major disruptions. This moment of renewed hope offers an opportunity to engage financially insecure Americans more effectively and to continue to harness participation and engagement in the years ahead.

Interestingly, financially insecure Americans consistently reported lower levels of trust in the election throughout 2024 (with an average pre-election trust of 61%).

However, the significant post-election increase seen across all groups brought their trust levels to 78%, nearly closing the gap with those who report being financially vulnerable. This significant shift suggests, along with an increase in optimism, that even those facing economic challenges can find renewed faith in the democratic process when elections are conducted smoothly. While ongoing efforts are needed to address trust deficits, this progress underscores the potential for building broader confidence in democracy and fostering greater civic engagement over time.

INFLATION TOPS CONCERNS FOR FINANCIALLY INSECURE AMERICANS IN 2024

Throughout 2024, inflation steadily rose in importance and emerged as the top concern for Americans across all generations, political ideologies, and economic backgrounds, overtaking other major issues like immigration and abortion. In October, for instance, 68% of Americans rated inflation among their top three concerns, compared to 44% for immigration, and just 33% for abortion.

Perhaps unsurprisingly, this trend is intensified for those experiencing financial insecurity. In October 2024, almost eight in ten (78%) financially insecure respondents identified inflation as a major concern, compared to just over half (52%) of those who are financially secure. Post-election, inflation was identified as the most influential issue in voting decisions by individuals across all financial backgrounds.

These findings suggest that to increase civic engagement among financially insecure populations, it is crucial to clearly connect issues of democracy and politics to pressing economic issues. By demonstrating the deep connection between political issues and financial concerns, we can make these issues more relevant and impactful for those facing economic instability, empowering them to engage more actively in shaping policies that directly affect their lives.

ENGAGING FINANCIALLY INSECURE AMERICANS MORE IN DEMOCRACY

Financial insecurity limits resources available for civic engagement and undermines the sense of agency and hope essential for participation. Economic hardship and the strain of inflation combined with a lack of perceived political impact often limit the time, resources, and mental bandwidth needed for activities like voting, volunteering, or community involvement. Yet, the post-election surge in optimism among this group provides a unique opening for action.

To bridge the gaps in civic engagement, and engage financially secure audiences more effectively:

- Prioritize Economic Narratives: Craft messaging focused on inflation and economic stability, framing solutions in relatable terms to build trust.

- Highlight Stories of Impact: Showcase relatable stories and highlight how civic engagement leads to real change, especially in vulnerable communities, to counter disempowerment.

- Leverage Moments of Optimism: Use the optimism surge to inspire action, using forward-looking messages to connect personal struggles to collective power and emphasize resilience.

- Meet People Where They Are: Use clear, inclusive language and reach people where they are, making civic engagement relevant to their lives.

- Create Low-Barrier Engagement Pathways: Encourage small, actionable steps like signing petitions or attending meetings, reinforcing that small acts can drive change.

By focusing on these strategies, we can help build bridges between financially insecure Americans and the democratic systems that need their voices, fostering a more inclusive and representative civic environment.

Interested in more on this topic or others? We’ll be continuing to track these key indicators to provide consistent, real-time feedback on the health of American democracy. Sign up for our latest insights here.

Methodology: Citizen Data surveys from June 2024 to November 2024 with an average N = 1000 registered voters, with an average MOE of +/-3%. Weighted to be representative of registered voters. Financial security measured using the Consumer Financial Protection Bureau (CFPB)’s Financial Well-Being Scale and aggregated scores into four financial security levels.

Share this report

Data for Democracy: Are Americans Hopeful Post 2024 Election? – December 2024

December 2024: Are Americans Hopeful Post 2024 Election?